In another matter the CFPB finalized an order against multiple parties for collecting debt-relief fees from consumers and misleading them regarding such fees. Get business latest news breaking news latest updates live news top headlines latest finance news breaking business news top news of the day and more at Business Standard.

Why the World Needs an Urban Rejuvenation for Sustainable Urbanization.

. CFPB Advertising Rule Should Raise Concerns for Marketing Companies. They blocked off the cul-de-sac on the 100 block of Everwoods Court SW. Effects of FIFA World Cup on the Economy.

The new interpretive ruling has effectively placed Internet marketing companies on notice as to the types of advertising campaigns that. And are asking people to avoid the area. Additionally the White House on April 18 2020 issued an executive order granting a temporary.

Firstly the time for WS was too long. Bad debts Yearly provision for bad debts not guaranteed by third parties and relating to sales of goods and services is tax deductible at up to 05 of the receivables gross value. Bad or forgiven debts.

The lower court did not accept and passed order on 2482020 for WS on 18112020. Effects of FIFA World Cup on the Economy. Barriers to India achieving Double Digit Growth.

BALANCE SHEET -- Statement of the financial position of a business as of a particular date. Looking beyond BRICS for the Next Economic Hotspots. The ability to.

Deduction shall no longer be permitted when the total amount of the bad debts reserve exceeds 5 of the above-mentioned gross value of the receivables as of the end of the fiscal year. Historic Greek Debt Relief Deal and the Lessons for Other Nations from this Crisis. If youre still reeling from the previous interest rate hike the Bank of Canadas latest increase for September by 075 percentage points may feel like more salt on a wound.

Barriers to India achieving Double Digit Growth. A deduction may be available for bad debts written off as bad before the end of an income year. BAD DEBT -- Debt which is unlikely to be paid.

Bad debts may usually be treated as losses and written off against a reserve for such debts. Generally a deduction will only be available where the amount of the debt was previously included in assessable income or the debt is in respect of money lent in the ordinary course of a money lending business. Looking beyond BRICS for the Next Economic Hotspots.

Some targeted customs relief has been established for companies on the front lines of the fight against COVID-19 such as the recent grant by the United States Trade Representative USTR of multiple exclusions from Section 301 tariffs on Chinese-origin medical supply products. Calgary police tweeted just before 9 am. Historic Greek Debt Relief Deal and the Lessons for Other Nations from this Crisis.

The statement will show the businesss assets in one column and its liabilities and owners equity in another column. I filed a civil suit and asked for interim relief us 39 1 and 2 read with section 151 CPC against managing committee for illegally asking payment on account of repair of building whereas the same is not in their scope. Why the World Needs an Urban Rejuvenation for Sustainable Urbanization.

Sri Lanka will not extend a state of emergency imposed to control anti-government protests as the situation in the impoverished nation has stabilised the Presidents office said Tuesday.

Pin By Ginger Twig On Lord Of The Rings The Hobbit Really Funny Pictures Really Funny The Hobbit

Fav Things Abt Chim Pt 1 Bts Memes Funny Kpop Memes Bts Funny

Gst Sales Purchase Deferred Tax Journal Adjustment Estream Software

Gst Sales Purchase Deferred Tax Journal Adjustment Estream Software

Newsletter 22 2019 Gst Guide On Transition Issue Page 002 Jpg

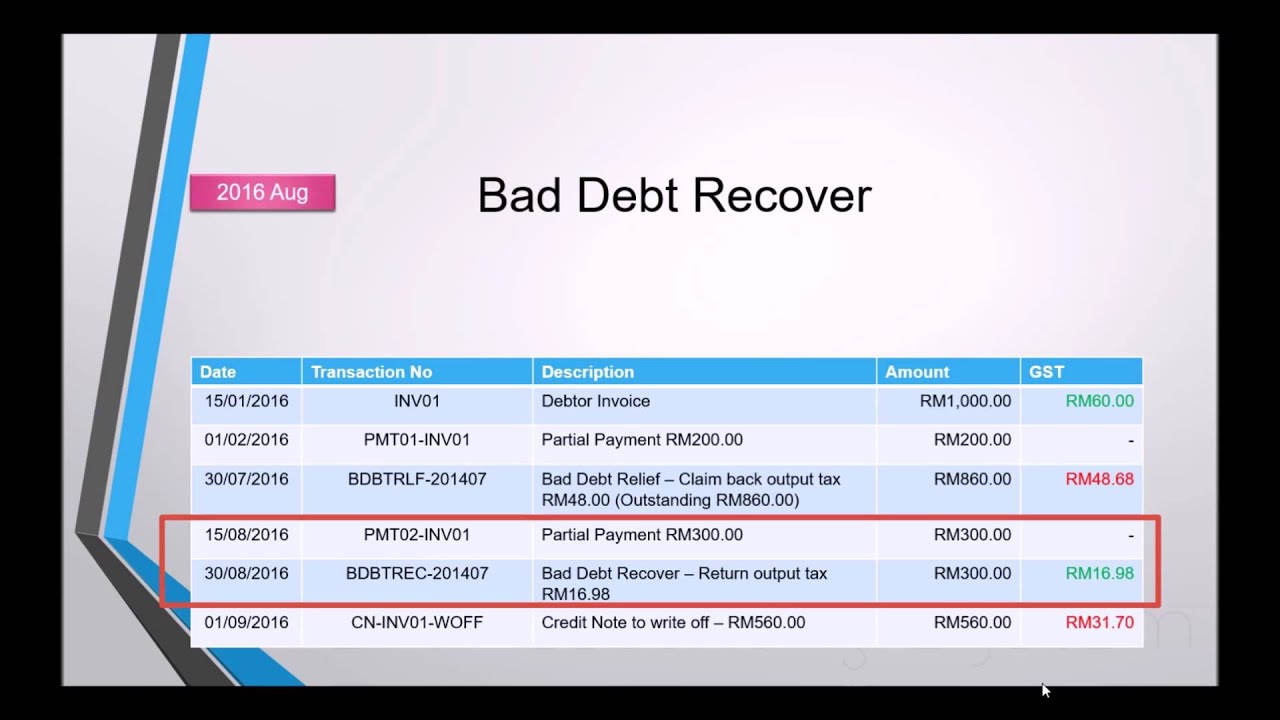

Sage Ubs Managing Bad Debt Youtube

Globla Indirect Tax Services Kpmg Global

Gst Bad Debt Relief Madalynngwf

Gst Bad Debt Relief Madalynngwf

Gst Bad Debt Relief Madalynngwf